There are more than four million electric vehicles on American roads, but fewer than 1,000 of them are heavy-duty trucks. On Tuesday, the three largest truck makers plan to announce a push to remedy that deficit by calling on governments and utilities to help them build many more places to charge big rigs.

Daimler Truck, which owns Freightliner; Navistar, which is controlled by Volkswagen; and Volvo Trucks have formed an association to push for chargers, improvements to the electricity grid and other measures they say are needed to promote battery- or hydrogen-powered trucks.

The new organization, Powering America’s Commercial Transportation, will be based in Washington and also be open to suppliers, nonprofit organizations and other groups.

The companies’ decision to work together underscores the degree to which the transition away from fossil fuels is dependent on government support and decisions made in Washington and state capitols. The Inflation Reduction Act, which Democrats passed in 2022, provides $1 billion for electric trucks, including tax credits of up to $40,000 for companies that buy them, as well as subsidies for charging infrastructure.

But officials are just beginning to distribute the money, and the truck companies complain that they have gotten less attention from federal and state governments than makers of cars.

“There’s a lot of funding that’s available out there from the federal government,” said Dawn Fenton, vice president of government relations and public affairs at Volvo North America. “There’s been little so far focused on the heavy-duty charging infrastructure.”

Only nine fast charging stations in the United States are capable of serving heavy trucks, according to data from the Department of Energy.

Transportation is the biggest source of greenhouse gases in the United States, and trucks, buses and vans account for 29 percent of vehicle emissions, according to Calstart, a nonprofit group whose members work in industry as well as government. Poorer communities tend to suffer the most from truck pollution because they are more likely to be near industrial zones or highways.

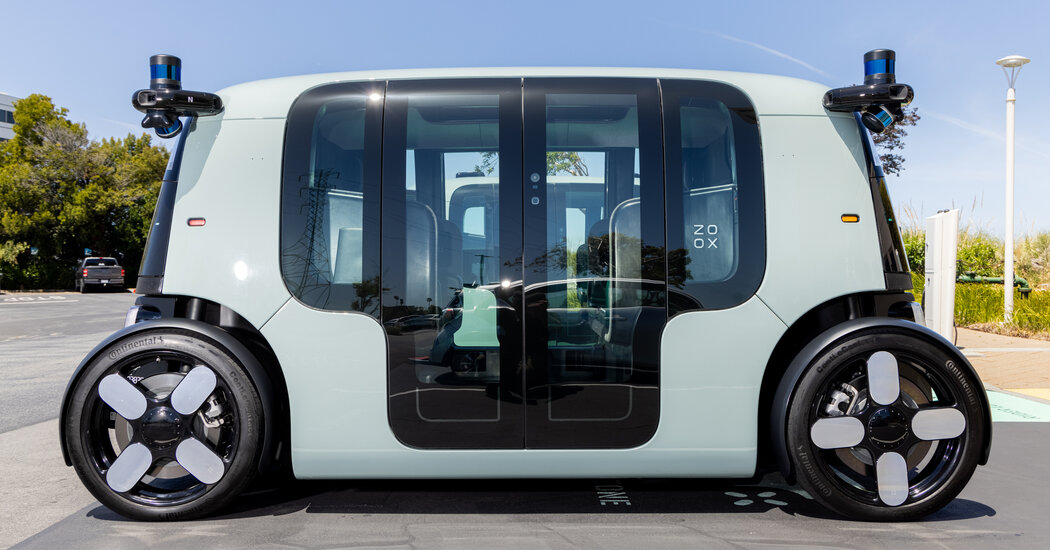

Eliminating those emissions is difficult. An electric truck requires a big, heavy battery that reduces how much stuff the vehicle can haul.

Zero-emissions trucks are also two or three times more expensive than diesel trucks, costing hundreds of thousands of dollars, although prices are expected to drop as companies increase production.

The truck makers say they are committed to selling emission-free vehicles, but environmental groups have accused them of trying to block policies that would force the industry to move faster.

This month, the Sierra Club, along with 40 other advocacy groups, sent letters to the chief executives of Daimler Truck and Volvo Trucks accusing them of trying to stymie stricter emissions standards. In comments on proposed regulations by the Environmental Protection Agency, both truck makers have lobbied for a slower introduction of new standards.

In the letter to Volvo’s chief executive, Martin Lundstedt, the group wrote, “Volvo Trucks U.S.A. must focus its efforts and resources on electrifying the transportation sector now, especially in the communities most impacted by truck emissions, instead of fighting policies needed to move the whole system faster.” The groups sent a similar letter to Martin Daum, the chief executive of Daimler Truck.

(Volvo Trucks is not part of Volvo, the carmaker, and Daimler Truck is separate from Mercedes-Benz.)

Truck makers face less competitive pressure than car companies. In the car business, Tesla has won over customers who previously drove cars made by Mercedes, General Motors and Volkswagen, forcing those companies to respond. The Tesla Model Y sport utility vehicle was the best-selling passenger car of any kind worldwide in 2023, according to JATO Dynamics, a market research firm.

No upstart truck maker has had comparable impact. Tesla has developed a long-haul electric truck called the Semi, but the company has not begun selling it in large numbers.

“We would have moved faster over the last five years if there was a zero emission truck company taking the lead,” said Katherine García, director of a Sierra Club program that promotes clean transportation.

Nikola once aimed to be the Tesla of the truck industry, but it has struggled since its founder, Trevor Milton, was accused of defrauding investors by lying about the abilities of the company’s technology. Mr. Milton was sentenced in December to four years in prison after a jury convicted him. He denies wrongdoing and is appealing. Nikola, under new management, shipped 79 vehicles in the first nine months of 2023, the most recent figures the company has disclosed.

The truck makers argue that they can’t be expected to sell battery-powered trucks when there are hardly any places to charge them. Electric trucks require extremely powerful chargers and, as a result, bigger connections to the electrical grid than are readily available. Many utilities have to upgrade old distribution lines, transformers and other equipment to be able to deliver the energy needed to refuel multiple trucks simultaneously.

Brien Sheahan, head of government relations and regulatory affairs at Navistar, said one customer had ordered a fleet of electric trucks and installed 20 chargers at its depot. But, he said, “they couldn’t get it energized by the utility.”

Shortcomings in the electrical grid are “going to be a constraint on our ability to scale the industry,” said Mr. Sheahan, a former chairman and chief executive of the Illinois Commerce Commission, which regulates electric utilities.

Ms. García of the Sierra Club said that, despite slow progress so far, she was optimistic. She noted that sales of electric delivery vans and other smaller trucks were growing quickly, in part because California and other states are compelling manufacturers to reduce emissions and providing incentives for truck buyers.

Delivery vans, like those used by Amazon, require less energy and typically drive relatively short routes. As a result, those vehicles can be charged overnight on less powerful chargers than those needed for heavy trucks.

“The market is really moving quickly,” Ms. García said. “We’re at the point where it is really going to accelerate.”