Move over, Microsoft and Apple. The stock market has a new king.

On Tuesday, Nvidia leapfrogged two of tech’s most storied names to become the world’s most valuable public company, according to data from S&P Global. Its ascent has been powered by the boom in generative artificial intelligence and surging demand for the company’s chips — known as graphics processing units, or GPUs — which have made it possible to create A.I. systems.

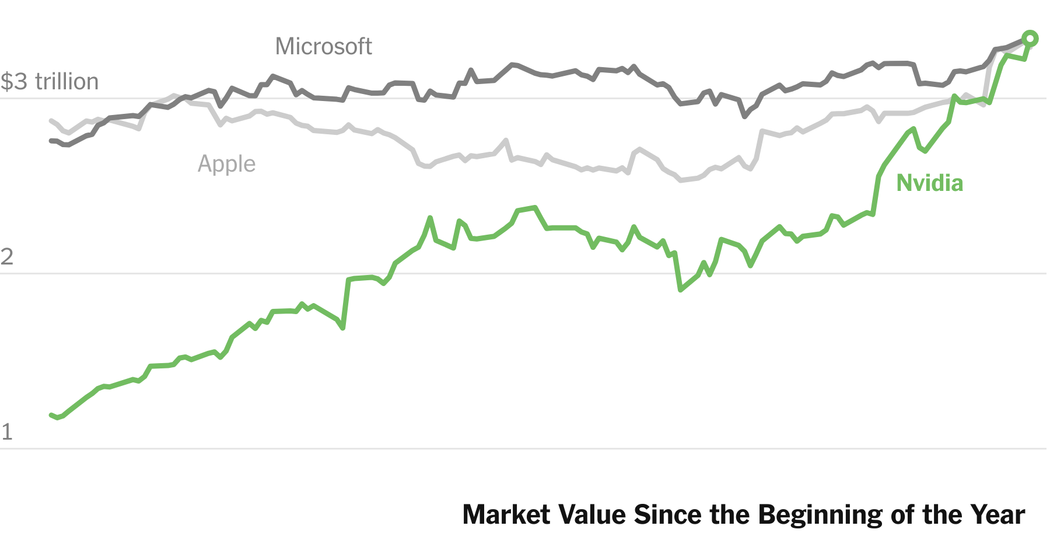

Nvidia’s rise is among the fastest in market history. Just two years ago, the company’s market valuation was over $400 million. Now, in the span of a year, it has gone from $1 trillion to more than $3 trillion.

On Tuesday, Nvidia’s rose 3.6 percent, lifting its market value to $3.34 trillion. Microsoft and Apple both fell, ending the day trailing the Silicon Valley chip maker.

Years before other big chip companies, Nvidia’s chief executive, Jensen Huang, bet that GPUs would be essential to building artificial intelligence, and he tailored his company to accommodate what he believed would be tech’s next big boom.

His big bet is paying off. By some measurements, Nvidia controls more than 80 percent of the market for the chips used in A.I. systems. Nvidia’s biggest customers regularly jockey for orders for chips to run computers in their giant data centers, and are building their own A.I. chips so they are not so dependent on one supplier.

“No one else fully saw or appreciated this,” said Daniel Newman, chief executive of the Futurum Group, a tech research firm. “They saw the trend, built for the trend and enabled the market. They can effectively charge whatever they want.”

Nvidia’s ascent has made Mr. Huang a celebrity in the tech world. After a computer conference in Taiwan early this month, he was surrounded by attendees who wanted his autograph, including a woman who asked him to sign her chest.

The company’s rise is reminiscent of dot-com era titans like Cisco and Juniper Networks, which built the equipment that ran communications networks for the internet. Cisco’s shares increased more than a thousandfold between its initial public offering in 1990 and 2000, when it briefly became the world’s most valuable company.

The speed at which Nvidia’s value has grown has been startling. Apple crossed $1 trillion in August 2018 and became the first $3 trillion company last June. Microsoft also took nearly five years to climb from $1 trillion to $3 trillion.

But Nvidia’s investors are betting more on its potential than on its current profits. Microsoft and Apple generate more than $85 billion in annual profits, while Nvidia generates $42.6 billion.

“The numbers have gotten so big so quickly that people worry: Is this sustainable?” said Stacy Rasgon, an analyst with Bernstein Research. “If the return on A.I. turns out to not be there, then the whole thing comes crumbling down.”

This is a developing story. Check back for updates.